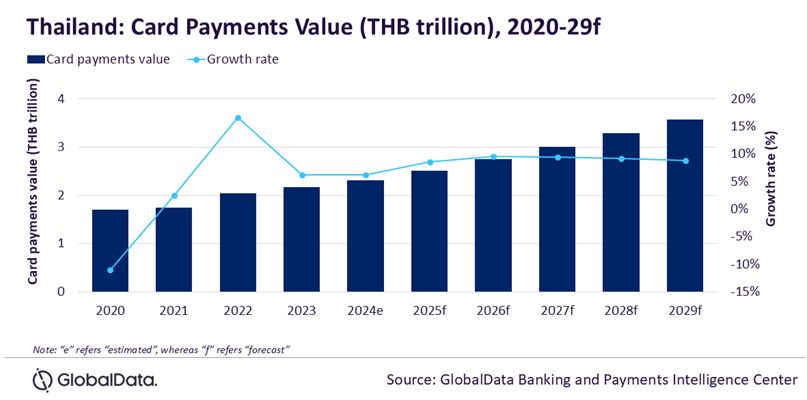

The Thailand card payments market is forecast to register a compound annual growth rate of 9.3% between 2025 and 2029 to reach 3.6 trillion baht ( US$101.4 billion ) in 2029, supported by a constant consumer shift towards electronic payments, according to a recent report.

Card payment value in Thailand registered a growth of 6.2% in 2023, finds GlobalData’s Payment Cards Analytics report, driven by the rise in consumer spending. The value grew further to register an estimated growth of 6.3% in 2024 to reach 2.3 trillion baht ( US$65.4 billion ).

“Thailand's payment landscape is witnessing a significant transformation, with the card payments growing at a robust pace,” says Ravi Sharma, GlobalData’s lead banking and payments analyst. “The total card payment transaction value is expected to reflect this growth, as the country embraces the shift towards electronic payments.

“The key drivers of this growth include government initiatives aimed at financial inclusion, the expansion of payment infrastructure, and the increasing adoption of contactless payment technology.”

Over the past five years, the Thai payment market, the report notes, has evolved considerably. The government and commercial banks have taken steps to promote financial inclusion and drive debit card penetration, such as offering low-cost bank accounts.

The Bank of Thailand, the country’s central bank, has also focused on enhancing agent banking regulations, allowing banks to appoint agents, such as convenience stores, to provide basic banking services, thereby promoting electronic payments and financial inclusion.

The growth of debit card usage, the report points out, is primarily driven by an expanding banked population and proactive initiatives by banks and government bodies to promote electronic payments. However, despite this growth, debit card usage remains largely confined to cash withdrawals.

On the other hand, credit and charge cards, the report highlights, are mostly favoured for payments due to the value-added benefits offered by banks, such as cashback, reward points, discounts and instalment payment facilities. This growth is supported by the rising middle class and a young, working population, which is driving the demand for credit facilities.

The popularity of payment cards, GlobalData shares, extends to the e-commerce sector, where debit, credit and charge cards accounted for a combined 15.7% of e-commerce transaction value in 2023.

In Thailand, contactless cards, the report adds, are becoming more popular as banks and scheme providers push this technology. The rising adoption of contactless card payments for transport services will support growth in the card payment space.

For example, in March 2023, UOB introduced a tap-and-go contactless payment service to its debit card holders at all MRT stations in Bangkok and Nonthaburi provinces, allowing the bank’s card holders to make payments by simply tapping on the contactless payment card reader at the ticket gates.

“Looking ahead, the total card payments market in Thailand is expected to continue its upward trajectory,” Sharma concludes. “The growth will be fuelled by several key trends, including improving payment infrastructure, an increasing preference for contactless technology and the strengthening of the e-commerce market.

“Additionally, the positive economic outlook for Thailand, driven by a rebound in tourism and rising consumer spending, will further bolster the cards and payment industry.”